Financial

Services

Robiquity delivers transformation in financial services FAST.

We understand the challenges in financial services and we know the impact that Intelligent Automation can have. IA can transform your business and deliver significant improvements in customer and employee experience.

Robiquity work with a broad range of financial services organisations where we have transformed ways of working and enabled employees to fulfil their core purpose.

Read more

Don’t take our word for it, this is what our financial services customers have to say

£1m

savings per annum

“Robiquity automation has enabled us to rebalance portfolios in line with our customers preferences on a monthly basis, which means their portfolios are tightly controlled which gives our customers peace of mind”

40%

Increase in lending capacity

“The impact Robiquity’s robots have had on our business operations is phenomenal.”

90%

of all ISA top ups are automated

“The breadth of experience they bring coupled with a can-do attitude means we have automated legacy processes quickly”

30k

hours saved annually

“The team integrated seamlessly with ours and their collaborative approach created a trusted partnership”

Read more about our financial services use cases:

USE CASES

Financial Services

Compliance

Completions

Financial Services

Compliance

Compliance Checks

Financial Services

Cancellations

Customer Cancellations

Financial Services

Customer Services

Fee Reversals

Financial Services

Fraud

Fraud Enquiries

Financial Services

Price Comparison

Gadget Cover

Financial Services

Administration

Loan Sale Premium

Financial Services

Marketing

Membership Cost Comparison

Financial Services

Business Monitoring

Post Offer Checks

Financial Services

Administration

Print Offers

Financial Services

Administration

Print To Document Storage

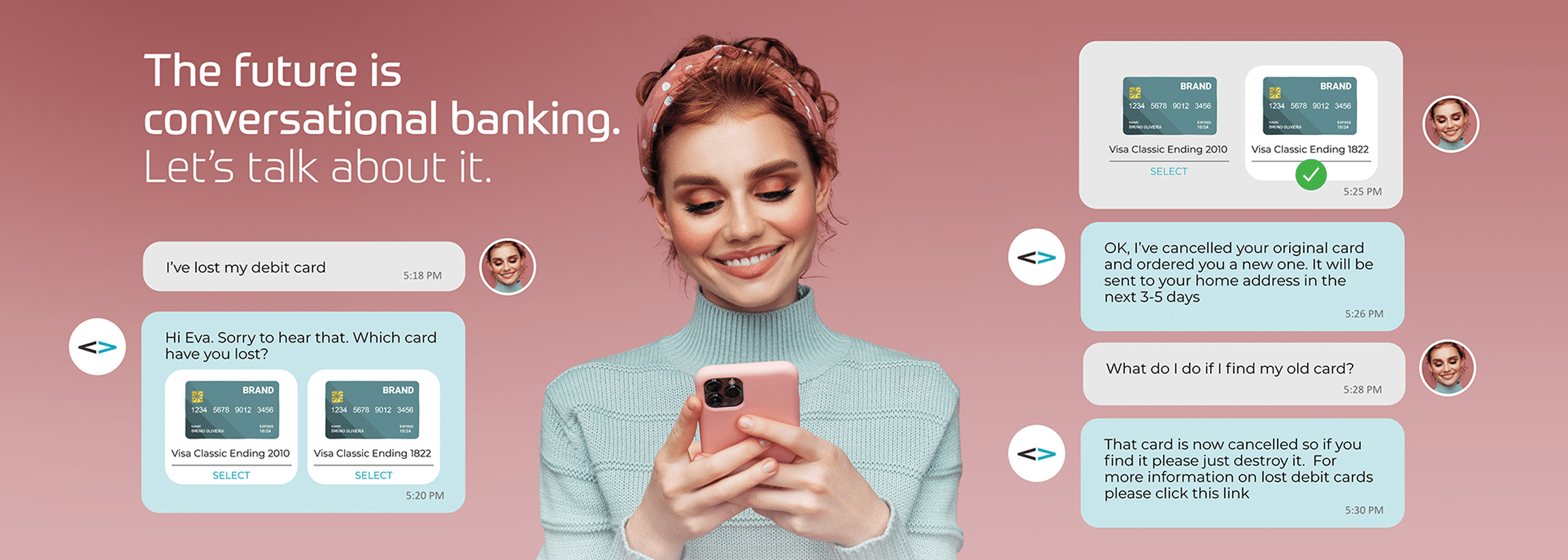

Conversational AI – The future of customer experience

Conversational AI, a technology that combines NLP, ML, NLU, and speech recognition to allow customers to interact naturally with businesses using messaging apps, social media, or web chat. Robiquity partners with leading conversational AI technology providers to provide a customer-centric solution that integrates with existing technology systems, resulting in secure and quick answers without human intervention, giving businesses a competitive advantage.

Here is a simple example of a traditional ‘Rule based’ chatbot VS a Conversational AI experience:

‘RULE BASED CHATBOT’ EXPERIENCE

Hello, please select from one of the following options:

- Existing order query

- Sales enquiry

- Customer service

- Technical enquiry

Where is my order?

I’m sorry I don’t understand your question. Please select from these 4 options:

- Existing order query

- Sales enquiry

- Customer service

- Technical enquiry

Select – Existing order query

Please enter your 10-digit order number

1234567899

Thank you, I will now put you through to a live operator

CONVERSATIONAL AI EXPERIENCE

Hi, how can I assist you?

Where is my order?

Your order has been dispatched and will be delivered to you by DPD between 10:30 – 11:00am

Thank you

Can I help you with anything else?

No, thanks